From the Editor’s Desk

Greetings!

We hope you have been enjoying the weekly market updates so far. It is a pleasure to deliver this news right to your fingertips and we hope you follow us.

We would appreciate it if you could share your comments so we can improve our work every week. It is our single-minded focus to make this newsletter the best it can be.

Thank you for reading it, subscribing to us, and sharing your valuable feedback. We hope you enjoy reading this as much as we did to curate it for you!

Key takeaways for the US

- Truckers’ Union strike in all Korean ports.

- Thanksgiving and Winter holidays make it hard to find truckers.

- Savannah and Houston Ports congestion improves..

Read on for more in-depth updates.

Ocean Freight Market Update

Asia → North America

U.S / CA

Various adjustments between Asia and the US East Coast

- Carriers are continuing to make capacity adjustments for their services from Asia to North America.

- Notable suspension of TP23 service by Maersk for Asia and the US east Coast. It is worth noting that they are adding Charleston call to the TP17 service.

- Enhanced rolling issues for low-price carriers like MSC and HPL. This is because most sailings are bi-weekly in November and December. This results in two weeks of delay by rolling once.

- 2M services have less visibility owing to carriers merging their services. They have included port calls in South America and European countries.

- MSC has claimed its latest notice, namely “ETAs are indicative and subject to change without prior notice”.

- Asia - USWC trade notices the spot rate already crossing its breakeven point, leaving no room for further reductions.

- This means most carriers will extend their USWC rates till December 14, 2022.

- USEC rates continue to drop despite this.

- Vancouver’s average waiting time in the market is around 25-35 days.

- At Maersk, the waiting time has been reducing owing to their timely terminal collaboration. This has brought the waiting time to almost zero days.

- This makes their Vancouver and Prince Rupert product transit time the market’s most competent ones.

Korean strike by truckers' union

- Pusan, Kwangyanf, Incheon, and other Korean ports are indefinitely striking by their truckers’ union.

- This strike has been ongoing since November 24, 2022. The export delivery and import pickup have been disrupted by this strike.

Conclusions

Rates: Some carriers dropped their rates. Others hold the same rates consistently.

Space: Space is open and with no equipment issues for Asia Pacific to North America.

Recommendation: We recommend blank sailings to continue. Book at least two weeks prior to the date your cargo gets ready.

Turkey → North America

- East and West Coasts have reported a globally stable situation.

- NYC vessel dwell is stable. However, it can reach up to 7+ days while Norfolk vessels at Anchor stable to 6.

- Savannah’s berth congestion is still high with at least 26 vessels at Anchor.

- The dwell is flat at 13.5 days for Savannah.

- Vessels in Houston decreased slightly at the Anchor to 7.

- This is owing to the fact that several vessels took advantage of the new virtual market system.

- However, dwell remains very high at Houston.

Conclusions

Rates: Slightly dropped rates have been recorded.

Space: Space open, no issues with equipment. The capacity problem persists only for Hapag Lloyd.

North America → Turkey

- A majority of USEC to Turkey services have low to medium capacity utilization levels. The space constraints are at a minimum.

- The Gulf Coast to Turkey services proceed with over 100% (very high) capacity utilization levels.

- The USWC to Turkey services are very limited in options. This results in a rather artificially high level of capacity utilization.

Conclusions

Rates: Stable rates in the recent course.

Space and capacity: The capacity remains open to Turkey. CMA is joining the group and adding an additional vessel to the EMA service. This is headed to the East Med.

North America Vessel Dwell Times

Terminal Updates

- Number of vessels in the queue in Los Angeles is stable at 5. This includes berth on arrival.

- Oakland vessels at Anchor have decreased by 2 each week. It is currently at 6 with dwell decreasing to 6 days for all vessels at harbor.

- Vancouver has improved to 4 days along with enhanced berth velocity.

Intermodal

- LA/LB on dock rail has improved its average dwell.

- The off-dock rail dwell has also been improved.

- The Intermodal Network has witnessed an overbalance and mild backlog of its Westbound and export volume to the WC.

- However, imports have declined and railroads are gearing up for peak domestic parcel season in the US.

- The chassis supply has remained tight in some major locations such as Chicago and Dallas.

- Railroad operators and unions are continuing to negotiate. The cooling-off period is looming and might expire at midnight on December 8, 2022.

- This cooling-off period is the time when both parties maintain a status quo. At this time, unions will not be able to engage with any strikes or work lockouts.

US Midwest and US Gulf Updates

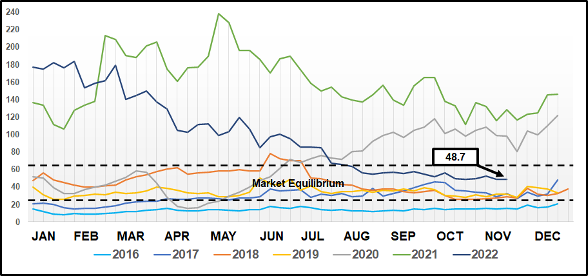

US Domestic Trucking Market Trends

- Tender rejections have fallen to a new cycle low of 5.05%.

- This was witnessed last in March 2020.

- The trucking carriers are notably rejecting only 3% of contract loads outbound from Los Angeles.

- They are also rejecting 4.5% of loads outbound from Chicago.

Final Market Updates

- Accepted tender volume down -12.7% Y/Y.

- Van rejections have slightly reduced to 3.8%

- Refrigerated rejections have sharply increased to 7.1%

- Flatbed rejections have slightly increased to 18.3%

- Heat map rolling W/W is displayed below for your perusal.

- Weather updates currently to depict the worldwide climate.

Parting Thoughts

After perusing the latest updates, we can safely conclude that the market is steadily improving. While some strikes are ongoing in Korean ports for the truckers’ union, we are still noticing good progress in other parts of the world.

Be careful while picking routes for cargo movement. We recommend taking a look at the weather reports and dwell time for each port before arriving at a conclusion. We also suggest you peruse the winter and Thanksgiving holiday season owing to how it affects the shipments.

We can expect an overall steady increase in the market owing to the trends presented above. Be sure to accurately research and make informed decisions accordingly.

We are grateful that you perused our newsletter till this point. Be sure to subscribe to us and stay notified about the latest weekly market updates. We also look forward to your valuable feedback to improve next time!